Open Doorway Loans and doorstep funds lending have received popularity as effortless and versatile possibilities for individuals in need of brief money support. These sorts of lending companies enable borrowers to access dollars without needing to go through the standard, frequently prolonged, mortgage software procedures linked to banking institutions or other significant fiscal establishments. Although the appeal of these kinds of financial loans may possibly lie of their simplicity and accessibility, it’s crucial that you totally fully grasp the mechanisms, advantages, and probable pitfalls prior to thinking of this sort of financial arrangement.

The notion guiding open up doorway loans revolves close to giving simple and rapidly use of resources, typically without the require for comprehensive credit history checks or collateral. This makes these financial loans attractive to individuals who may not have the most effective credit rating scores or individuals who deal with economical difficulties. In contrast to standard loans that will just take days as well as weeks to get accredited, open door financial loans generally supply funds to your borrower’s account in just a subject of hrs. This speed and comfort are two from the most vital components contributing to your rising acceptance of those lending companies.

The process of implementing for these financial loans is straightforward. Frequently, borrowers will need to supply fundamental private info, evidence of revenue, and bank details. Since open up door financial loans are generally unsecured, lenders take on extra chance by not demanding collateral. Due to this fact, the interest premiums and fees affiliated with these loans are typically greater when compared to conventional lending alternatives. While this can be a drawback, the accessibility and velocity of funding usually outweigh the upper expenses For lots of borrowers in urgent fiscal situations.

Doorstep dollars lending, given that the name indicates, will involve the delivery of cash on to the borrower’s household. This service is built to cater to those who prefer in-individual transactions or individuals that may well not have entry to on the web banking facilities. A representative in the lending enterprise will pay a visit to the borrower’s household at hand around the money and, in many conditions, acquire repayments over a weekly or monthly foundation. This own contact can offer a sense of reassurance to borrowers, Primarily individuals that may be wary of on line transactions or are fewer accustomed to digital money companies.

Even so, one will have to evaluate the larger interest premiums and fees normally related to doorstep funds lending. These kinds of financial loans are deemed superior-possibility by lenders, given that they're unsecured Which repayment collection depends heavily around the borrower’s capability to make payments after some time. For that reason, the fascination charges billed can be considerably better than These of standard loans. Borrowers should be cautious of this, as being the advantage of doorstep dollars lending may perhaps come at a considerable Value.

One more element to take into consideration is definitely the repayment overall flexibility that these financial loans offer. Quite a few open doorway financial loans and doorstep money lending products and services supply versatile repayment options, that may be advantageous for borrowers who may not be in a position to decide to strict payment schedules. However, this adaptability might also result in more time repayment intervals, which, combined with substantial fascination costs, could cause the borrower to pay for substantially far more over the life of the bank loan than they to begin with borrowed. It’s crucial to assess whether the repayment construction of those loans is truly manageable and according to just one’s financial circumstance in advance of committing.

One of the key components of open up door loans is their capacity to accommodate men and women with lousy credit scores. Standard banks usually deny loans to Individuals with significantly less-than-ideal credit histories, but open door lenders usually concentrate extra to the borrower’s existing ability to repay as an alternative to their credit rating previous. Whilst this can be advantageous for people seeking to rebuild their monetary standing, it’s vital to become mindful of the risks included. Failing to meet repayment deadlines can more hurt a person’s credit score score and perhaps lead to extra severe economical problems down the line.

The approval procedure for these financial loans will likely be fast, with selections made within a number of hrs, and money in many cases are obtainable the exact same day or the next. This immediacy will make these financial loans a lifeline for individuals experiencing unpredicted bills or emergencies, for example car or truck repairs, health care expenses, or other unexpected financial obligations. Nonetheless, the ease of use of money can occasionally bring about impulsive borrowing, which could exacerbate financial complications as an alternative to resolve them. Borrowers should normally contemplate whether or not they truly have to have the bank loan and should they will be able to find the money for the repayments in advance of proceeding.

One more advantage of doorstep funds lending is usually that it enables borrowers to receive money without the want to visit a bank or an ATM. This may be specifically handy for those who may well are in distant locations or have limited usage of economic establishments. On top of that, some borrowers may well sense additional at ease addressing a representative in human being, particularly if they have problems about managing financial transactions on the net. The personal mother nature with the support can foster a more robust partnership in between the lender along with the borrower, however it is vital to do not forget that the substantial price of borrowing stays an important consideration.

You can find also a specific standard of discretion involved with doorstep dollars lending. For people who might not want to disclose their monetary scenario to Other people, the chance to cope with personal loan arrangements from the privateness in their house might be pleasing. The private interaction using a lender representative may also offer you some reassurance, as borrowers can examine any issues or queries right with the person delivering the mortgage. This direct conversation can in some cases make the lending procedure truly feel fewer impersonal than managing a faceless on-line application.

Within the downside, the advantage of doorstep income lending can occasionally cause borrowers taking out a number of financial loans at the same time, especially if they locate it hard to help keep up with repayments. This could certainly develop a cycle of personal debt that is tough to escape from, particularly When the borrower is not really controlling their funds diligently. Responsible borrowing and a clear idea of the mortgage conditions are necessary to stay away from this sort of predicaments. Lenders may well provide repayment ideas that appear flexible, nevertheless the higher-interest rates can accumulate immediately, bringing about a big personal debt stress with time.

While open up doorway financial loans and doorstep money lending present various Positive aspects, such as accessibility, pace, and adaptability, they don't seem to be devoid of their troubles. Borrowers really need to cautiously evaluate the stipulations of these financial loans in order to avoid receiving caught inside of a debt cycle. The temptation of swift income can from time to time overshadow the very long-phrase economical implications, especially In the event the borrower is just not in a powerful situation to generate timely repayments.

Certainly one of the key considerations for just about any borrower really should be the full price of the bank loan, together with desire premiums and any added charges. While the upfront simplicity of these loans is attractive, the actual amount repaid as time passes may be drastically bigger than anticipated. Borrowers should weigh the instant great things about obtaining income immediately versus the prolonged-phrase financial effects, notably In the event the loan phrases extend more than quite a few months or maybe years.

Additionally, borrowers must also be aware of any probable penalties for cash loans to your door late or skipped payments. Lots of lenders impose steep fines for delayed repayments, which may additional improve the total cost of the loan. This can make it more important for borrowers in order that they have a good repayment approach in place ahead of taking out an open door financial loan or deciding on doorstep hard cash lending.

Regardless of the likely disadvantages, you can find situations exactly where open doorway loans and doorstep funds lending is usually effective. For individuals who have to have use of cash swiftly and don't have other viable fiscal alternatives, these financial loans offer an alternative that can help bridge the hole throughout hard instances. The real key is to make use of these loans responsibly and guarantee that they're part of a effectively-assumed-out economic system rather then a hasty decision pushed by fast needs.

Sometimes, borrowers may discover that these financial loans function a stepping stone to far more steady economical footing. By creating well timed repayments, men and women can exhibit fiscal obligation, which can enhance their credit history scores and permit them to qualify For additional favorable mortgage phrases in the future. However, this consequence is dependent seriously on the borrower’s capacity to control the loan efficiently and steer clear of the pitfalls of large-desire financial debt.

It’s also well worth noting that open doorway financial loans and doorstep income lending are frequently issue to regulation by economic authorities in various countries. Lenders will have to adhere to specified suggestions with regards to transparency, desire prices, and repayment conditions. Borrowers need to be certain that they're coping with a respectable and controlled lender to avoid likely cons or unethical lending practices. Checking the lender’s credentials and looking through assessments from other borrowers might help mitigate the chance of falling target to predatory lending strategies.

In conclusion, open door loans and doorstep funds lending offer a effortless and obtainable solution for individuals facing instant economic issues. Even though the benefit of acquiring these loans could be interesting, it’s critical to technique them with caution and a clear understanding of the associated costs and risks. Borrowers should really diligently Examine their capacity to repay the bank loan inside the agreed-upon conditions and pay attention to the prospective lengthy-term economical outcomes. By doing so, they can make educated choices that align with their financial aims and stay away from the common pitfalls of superior-fascination lending.

Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Catherine Bach Then & Now!

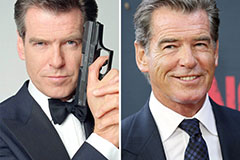

Catherine Bach Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!